The advantage of leveraging today’s consumer shopping behavior, location and online convenience

Over the past 20 years, people have grown used to convenience, variety, and delivery to their doorstep. This modern-day shopping paradigm was ushered in by one of the Big Four, Amazon. From books to speakers, to toilet paper; the dominant face of retail sells 480 million products online, leading some of us to rethink the purpose, value and hence overall fate of brick and mortar retail stores.

Well, It’s Not Dying But it is Changing!

Leveraging the Familiar

So unless you are a misanthrope or a mountain man, you are most likely making daily or weekly visits to a few retail stores and buying stuff. In fact, more than 90% of purchases are still made by consumers going to an actual store location, waiting in line and dragging it home in their vehicle. Wow, that just made me feel a little tired and inconvenienced just writing that.

All jokes aside, e-commerce accounted for 8.5% of all retail in the first quarter of this year, registering $105 billion sales out of a total $1.25 trillion, according to the latest data released by the U.S. Census Bureau. Now to add to that is a huge number of customers using the “click and collect method”, in which shoppers actually purchase online and then go and pick up the item in the store, rather than having it shipped to them. So the benefit for the retailer in this particular case is getting people to walk into the physical store, where they are more likely to buy additions products. According to.The International Council of Shopping Centers (ICSC), nearly one-third of consumers this past holiday season used the click and collect method; even more important, 69% of those shoppers then went and purchased additional items in that store, and 36% of them made a purchase in another store. What this means is that retail stores still have relevance or a raison d’etre. As most people still travel to a store to buy stuff, but which store that is is going to be increasingly in question.

And as the American speculative fiction author William Gibson once famously said: ”The future is already here — it’s just not very evenly distributed.” The current trends are not in the favor of most retailers and they will absolutely need to strive for innovative ways to keep shoppers returning to them. To accomplish this, brands could benefit by realizing that consumers already have a bunch of ingrained habits. “Many retailers have built on the programs that had already established customer behaviors with like circulars,” said Karl Denzer, SVP general manager at InComm, a provider of prepaid products and payment processing solutions. “Retail customers are all trained to look at what used to be physical ads which show the sales and special promotions they had available. It’s not a hugely difficult migration behavior for customers to now look at the same communications on digital channels now.”

“What is confirmed and does drive customer behaviors in stores, are the notifications around the digital circulars, email and for the merchants that have loyalty programs, notifications to their loyalty customers around special deals.”

Forrester did a recent analysis on the impact of online coupons and uncovered data that promotional incentives are still, in fact, extremely relevant even as the retail industry is constantly evolving to meet shifting consumer journey habits. With 63% of consumers saying that promotions help close the sales when the rest of people are not sure or undecided about a particular product, brands and retailers need to always be testing what is the best way to reach their audiences and deliver promotions in this new online/offline merged environment.

Data that Matters: Location

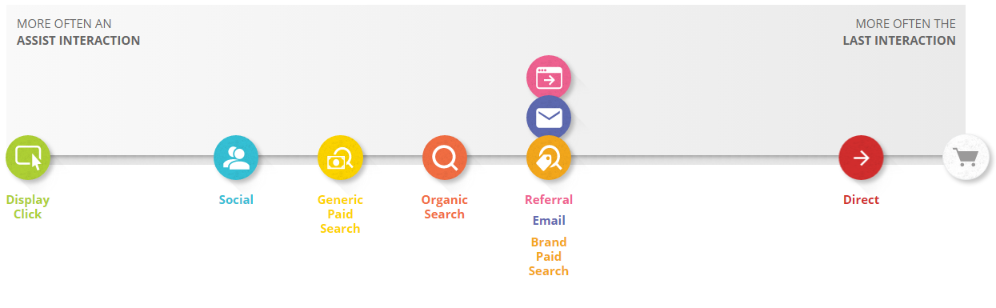

Many online marketers look at multiple data points:

- Demographics (gender, age, income)

- Psychographics (hobbies, interests, attitudes)

- Behavioral data (websites visited)

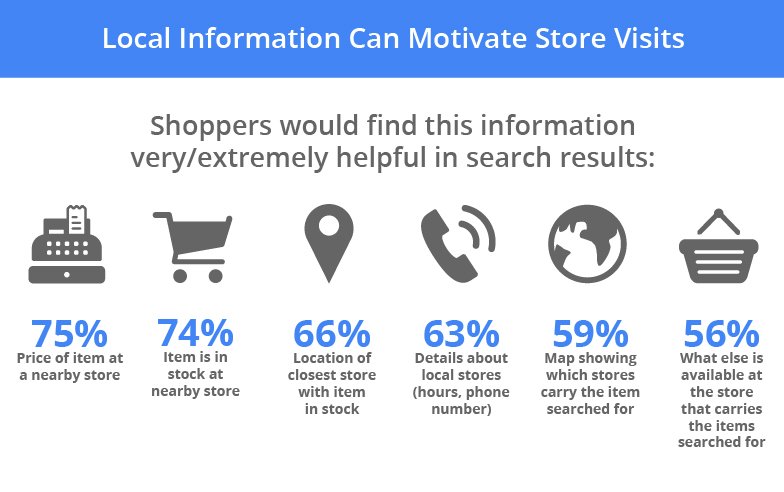

But when it comes to driving in-stores purchases, however, location is usually the most important piece of information. It is the data point that is scarily accurate, thanks to our smart phones. Mobile search is becoming a larger part of the retail shopping experience. 9 out 10 customers have used their smartphones while in store. More than half used them to compare prices, while almost half looked up pricing info and just over 40% checked online reviews.

“Being able to understand where the consumer is while they’re on the go, being able to send an offer and an ad that shows up at the right time, to be able to ultimately predict what search intent that user might have, is really critical the omnichannel buyer’s journey. Comparing it to an old-world model, where you’re on your PC with a display ad that’s not targeted—those days are over in terms of any sort of effectiveness.” Bill said.

Graham Charlton, editor chief of Sales Cycle, notes that “Despite the opportunity to target customers based on their locations, just 22% of marketers agree that they are exploiting hyper-local advertising to its full potential.” This stat alone presents a fairly large opportunity for both brands and retailers to leverage digital ads to drive more foot traffic shoppers into the stores.

Here is where data scientists and digital agencies can help, some retailers are sitting on billions of data points, they have the power and the information to target and deliver hyper-relevant ads while a person is on the go. Their most critical asset is getting people in the store. Today we are living in a digital age, and we not only have the data, but we need to be able to have predictive analytics as well. There is ton of opportunity at the enterprise brand and retail level to be able to to use their huge pile of data to ultimately drive better allocation marketing spend, not just in connecting a retailer to the consumer, but in helping them run their business by understanding what the consumers are actually doing.

The beauty retailer Sephora noticed how often its customers searched on their phones while standing in the store aisles. While many retailers fear that customers are using mobile to shop competitors, the Sephora team understood the power of mobile and was eager to see how the brand could tap into mobile behavior in a helpful and meaningful way. The company learned that most of their clients were looking for reviews of the products they had in their hands, or trying to remember which shade of makeup they’d bought last time. With these needs-based insights in hand, Sephora developed a mobile website and app functionality specifically to serve shoppers in those moments.

The Convenience of Online

The ride-sharing startup Uber uses and leverages digital to create seamless physical transactions (ride service requests, payment), enhancing a service that can only be accomplished in person. Retailers and brands could apply this type of mindset and ask the question: what can be done online that is convenient and enhances the consumer’s in-store experience? Let’s use the drug store retailer CVS as an example. CVS allows shoppers the ability to go online, order and pay, then consumers can select to have photos either picked up or delivered. Now picking them up without standing in a long line to pay makes for a more convenient customer experience, and doubly can drive more in-store purchases by just getting the person to step foot in the door.

The ease of use of online creates two positives:

- First, it helps to create potentially habit-forming or habitual occurrences that enable more in-store shopping activity

- Second, it proves there is a definitive link or correlation between online actions or activity and in-store engagements.

Now the second positive is sometimes harder to measure and attribute in our Omni-channel age, thus it can be thought by some to be the holy grail for both the advertiser and the retailer.

Jay Klauminzer, Vice President of Local Deals at Groupon, has noticed that “On the merchant side, one of the challenges is going to be attribution on mobile. Using affiliates are super easy since we can drop a cookie and know if they completed that purchase.” But here is where it can get a little more confusing “what if I want to find out if that mobile person I don’t have a cookie for actually came into my store? So, the notion of how you do online to offline attribution is going to be really important so retailers can build ROI to these campaigns. They’re all struggling to get people in the door, and so the services that prove they got them in the door are going to be the most valuable.”

Another marketing option is to use a geolocation-based push that gives shoppers a custom coupon code that will integrate directly with the point of sale upon check out.

There is also something called card-linking, where an offer is then added to a person’s credit card, meaning the customer does not need to even to present a voucher anymore to get the deal. This can be a win-win scenario, the customer experience requires nothing from them, and the advertiser gets to prove their effectiveness as the retailer benefits financially from the campaign.

The mobile world is changing, so don’t be surprised if you start seeing companies building more technologies that focus on convenience. Direct mail flyers are dying, so people are less inclined cutting up physical coupons and dragging in their purse with them into a store. People want something that is easy to use, and accessible on their phone. The idea of convenience using technology and shopping is only going to get bigger in next few years.

The notion of convenience is often attributed to personalization, where the experiences for the customers are directed towards them getting what they want when they want it. Google calls this “Micro Moments” where, thanks to mobile, micro-moments can happen anytime, anywhere. In those moments, consumers expect brands to address their needs with real-time relevance.

Retail brands have the opportunity to impress and engage their savvy shoppers in new ways. People want to feel that the retailer understands them, and customization is a way to accomplish that. Shoppers want stores to provide experiences tailored just for them; 85% say they’d be more likely to shop in places that offer personalized coupons and exclusive offers in-store.

Investing In Search will be Crucial to Getting Customers to Your Store (Period).

Investing In Search will be Crucial to Getting Customers to Your Store (Period).

We know how valuable it is to bring someone to your store but how to get them there. Today, it starts at the search bar, but tomorrow — thanks to advancements in AI, voice search, and mobile technology — the way customers find products is likely to change dramatically.

Instead of returning a mess of blue links when people search maps and apps, search engines are returning direct answers for “children’s clothes near me” or “where’s the nearest pharmacy.” Try searching for a Samsung TV on your mobile device. The local stores that rise to the top are no coincidence.

Digital is the Future and Key to Driving In-store Sales

Even a massive industry player like Salesforce with their recent purchase of DemandWare is eyeing physical retail as the next opportunity for disruption. These companies are rewriting the playbook for retail and providing marketers with a comprehensive view of their customer’s experience and journey.

So, with Amazon’s M&A Whole Foods deal, along with Walmart’s $3 billion acquisition of Jet.com last year, what has become quite clear, is that digital convenience, tons of data and physical experiences will be increasingly merged to create a new world of digital/physical retail experiences. A recent article by VentureBeat noted that Walmart is possibly looking to use facial recognition AI to help scan for unhappy shoppers at checkout to prevent churn. We don’t know how emerging tech will all develop and play out exactly.

It’s the world in which in-store shopping activity will be activated, driven and enhanced by new and developing digital technology components that can deliver the right product, to the right person, at the right time and at the best price.

Investing In Search will be Crucial to Getting Customers to Your Store (Period).

Investing In Search will be Crucial to Getting Customers to Your Store (Period).